While automated accounts payable (AP) tools like SAP, Oracle, and QuickBooks have revolutionized invoice processing, mitigating the error rate by as much as 90% in many cases, certain complexities still evade their reach. We have seen sophisticated AP systems struggle with high-risk areas, like processing handwritten invoices, validating PO mismatches, handling multi-currency line items, or identifying fraudulent invoices. These edge cases often fall outside the scope of rules-based automation, but they can have a serious impact on your cash flow, vendor relationships, and audit readiness.

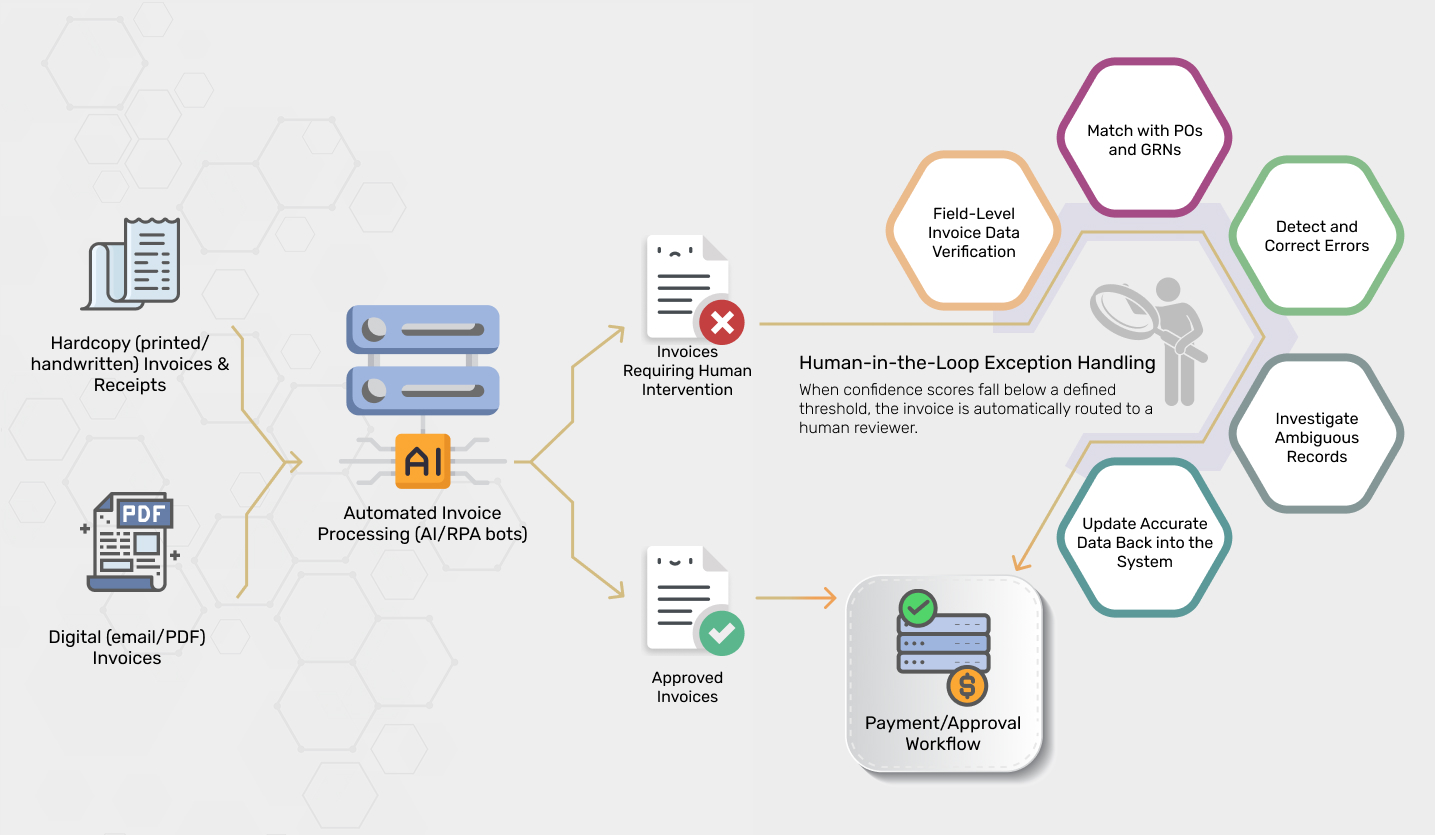

This is where our human-in-the-loop invoice validation process comes into play. Our invoice processing services complement your existing accounts payable (AP) systems by integrating expert oversight at critical failure points in your invoice workflows.

Our experts correct errors in OCR/AI-extracted data, ensuring full accuracy.

We handle complex partial and multi-PO cases that automation often misses.

Edge cases are validated by subject matter experts to maintain contextual accuracy.

We conduct manual checks to eliminate duplicate invoices.

Backlogged approvals, data inconsistencies, incomplete documentation, policy violations, unverified charges – our invoice processing company solves the real bottlenecks in accounts payable operations.

Our invoice validation services ensure that all the details extracted and processed by automated invoice processing tools are accurate and complete. We manually review and correct invoice data at the field level (such as invoice numbers, payment dates, line items, vendor names, total payable amount, tax details, and GL code). In cases where essential information is missing or incomplete, our invoice data processing team cross-references using original invoices and updates the records.

Our team performs precise 2-way and 3-way invoice PO matching, cross-verifying indexed invoice data against Purchase Orders and Goods Receipt Notes to protect your business from overpayments and fraud. This PO matching service ensures that every payment request is approved and also serves as an additional QA layer on the data processing capabilities of the automated invoice processing tool.

Our invoice reconciliation service helps businesses with large transaction volumes stay audit-ready. We match invoices with payment records, vendor statements, and ledger entries to ensure accuracy. This process quickly flags and resolves issues such as duplicate payments, missed credits, or data mismatches so your financial records remain accurate and reliable.

We provide data labeling services for businesses that use a proprietary invoice processing or AP automation system/tool, and need assistance with AI training or retraining. Our team delivers precise annotations for OCR pipelines, machine learning models, and AI-driven exception handling. The structured training datasets help fine-tune your systems, boosting both efficiency and reliability.

Have Any Other Specific Requirements?

Contact our Invoice Processing TeamWhen you choose to outsource data cleansing services to us, we alleviate the burden from your shoulders, providing flexible solutions tailored to your data type. We have catered to a diverse global clientele ranging from dynamic startups to Fortune 500 companies.

“Before partnering with DataEntryIndia.in, undeliverable emails and low engagement rates were draining our resources. Their data cleansing expertise reduced our email bounce rate and ensured our messages reached the intended inboxes. This, combined with a 10% rise in click-through rates, translated to a significant increase in qualified leads.”

"As an e-commerce company, high-volume invoices were a major bottleneck. We had constant payment delays and disputes because of PO mismatches. The invoice validation and exception handling team from DataEntryIndia.in streamlined our entire process. Our payments are now on time, and our vendor relationships have never been stronger. It was the best decision for our cash flow.”

"Our donor database was flooded with inconsistent and duplicate data. We needed a reliable partner to clean things up, and DataEntryIndia.in was the perfect fit. Their data cleansing solution helped us identify hundreds of new potential donors we hadn't reached before. This has opened up a wealth of new fundraising opportunities for us.”

We take a collaborative approach to provide customized B2B data cleansing services according to your industry type. We cater to a diverse range of verticals, including:

At our end, invoice data validation starts after your AP automation system has scanned and indexed the invoice data. This is where our experts step in—reviewing, verifying, and correcting every detail that automation might miss, ensuring your AP records are 100% accurate, compliant, and ready for payment.

We bring a rich history of solving complex data challenges for global businesses to every engagement.

Explore how we help clients achieve better data integrity and improve AP workflows with an invoice processing service.

Our invoice auditing and verification services are a must-have for organizations that have already invested in invoice processing automation but continue to struggle with accuracy gaps, compliance challenges, and complex exception handling scenarios. Our human-in-the-loop invoice validation approach particularly benefits companies experiencing persistent quality issues despite having sophisticated AP systems in place.

Organizations dealing with diverse vendor types, varying invoice formats, and complex approval workflows find our invoice validation services essential for maintaining accuracy standards that automated systems alone cannot achieve.

Companies preparing for financial audits, dealing with regulatory scrutiny, or operating in highly regulated industries where invoice accuracy directly impacts compliance reporting and risk management.

Our invoice processing company brings valuable local expertise to organizations managing invoices across various subsidiaries, currencies, or tax jurisdictions, ensuring precise handling in areas where in-house capabilities fall short.

For businesses aiming to optimize existing accounts payable investments, our invoice processing outsourcing services provide a cost-effective solution, eliminating the need for new software or full-time specialized hires.

For organizations implementing new ERP systems, navigating mergers/acquisitions, or restructuring AP processes, our human-powered invoice verification services offer the temporary expert support needed to maintain operational continuity during these transitional phases.

No matter which AP software you use, our invoice verification and validation services support all leading tools and systems. We add a crucial layer of accuracy through a rigorous quality assurance process.

We offer invoice verification and validation services to diverse sectors:

We manage the complexity of high-volume vendor invoice processing, helping you accelerate payments and optimize cash flow.

Our freight invoice processing services ensure accuracy in shipping charges, helping you reduce overpayments and resolve disputes faster.

We provide medical bill processing services to prevent billing errors, ensuring compliance and faster insurance claim settlements.

Our legal invoice processing services verify invoices against contract terms, helping you maintain billing compliance and avoid costly disputes.

We offer utility invoice processing services to verify accurate consumption and charges, leading to significant cost savings.

Our service verifies supplier invoices to prevent payment errors, which helps maintain smooth operations and avoid production delays.

We validate transactions against financial compliance standards to mitigate risk and help you avoid penalties.

We reconcile claims and premium invoices with your policy data, maintaining data integrity during high-volume billing cycles.

Manage complex invoices for property management, maintenance, and utilities, performing invoice reconciliation to correct errors and improve budget accuracy.

With over two decades of expertise in data processing and management, our invoice processing company is recognized for its exceptional service quality, unparalleled accuracy, and prompt turnaround times. Rather than replacing your existing automation workflow, we augment it with human supervision, enhancing artificial intelligence and machine learning invoice processing for greater precision and efficiency.

Outsourcing invoice processing shouldn't mean compromising data security. We eliminate this risk through our data protection protocols: strict adherence to NDAs, encrypted VPN access, SSL data transmission, and compliance with GDPR and HIPAA regulations. Your confidential information stays secure throughout this process.

We specialize in processing invoice data and seamlessly integrating it into your existing financial systems, such as SAP, Oracle, or Microsoft Dynamics. By aligning with your existing financial infrastructure, we enhance operational efficiency and ensure accurate financial records.

Our invoice processing team consists of specialists who excel at resolving the complex scenarios that cause automated systems to fail. From multi-PO matching to compliance validation, we handle the intricate cases that require business context and analytical judgment that your accounts payable software cannot provide.

Operating across multiple regions, including the US, UK, Asia-Pacific, and beyond, we offer full multi-timezone compatibility to ensure quick turnarounds. When your automated systems flag invoices for review, our experts provide prompt resolution for critical exceptions to ensure timely payments.

A single point of contact is assigned to you at the beginning of the project for consistent and proactive support. They share updates with your team, handle escalations, and ensure service quality meets your expectations.

Understanding the diverse needs of businesses, we offer flexible engagement models, including hourly, fixed-price, and dedicated team options. This adaptability enables you to select a model that best suits your budget and operational requirements, ensuring cost-effective solutions without compromising on quality.

At DataEntryIndia.in, we take data security and confidentiality as seriously as the invoice processing itself. Here's how we protect your financial data:

We follow rigorous quality and security protocols as an ISO 9001:2015 and ISO 27001:2022 certified company.

We do not store any data and enforce strict non-disclosure agreements and controlled data access measures.

Our invoice data validation approach aligns with applicable region and industry-specific regulations, like HIPAA.

We ensure that invoice information is transferred through secure channels, preserving confidentiality and safeguarding against unauthorized access.

When you outsource invoice processing to DataEntryIndia.in, we ensure 99.95%+ accuracy through an approach that combines the speed of AI automation with the oversight of human experts. While AI extracts and indexes data, our specialists review, verify, and correct any details that automation might miss. This ensures 100% accuracy, compliance, and payment readiness, especially for complex or non-standard invoices.

Yes. As part of our vendor invoice processing services, we handle invoices without purchase orders, such as utility bills, recurring services, or one-off purchases. Our team cross-references these invoices against contracts, historical data, or predefined rules to ensure accuracy and compliance, preventing discrepancies from affecting your accounts payable process.

Absolutely. We handle multi-currency and international invoices with ease. We can also accommodate various compliance standards for different countries/industries, ensuring all invoices, whether domestic or international, are processed accurately and in compliance with local laws.

Our process includes multi-stage data validation, where specialists manually cross-check all fields against original documents. We perform two- and three-way PO matching, verify vendor legitimacy, and validate compliance with industry-specific regulations like HIPAA and GDPR. This meticulous approach eliminates errors and protects against financial risks.

We have a robust exception handling support protocol. Invoices with complex issues are flagged by your AP Automation tools and reviewed by our experts. We work to resolve these exceptions based on predefined rules. Any cases that require client input are escalated to your AP team with a detailed summary, ensuring transparency and quick resolution without payment delays.

Absolutely. We adapt to your current technology stack, including platforms like SAP, Oracle, and QuickBooks. Our services operate as a remote extension of your AP team, with secure, seamless integration that doesn't disrupt your existing workflows.

Need to Process Invoices Faster?