Are your in-house data mining limitations undermining financial forecasts?

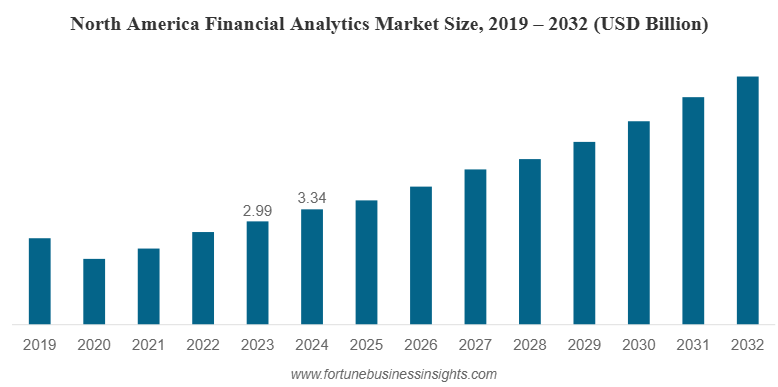

According to a Fortune Business Insights report, businesses stay ahead of the competition by relying on data-driven decision-making, as it reduces the possibility of biased or subjective judgments. The global financial analytics market is projected to reach USD 22.64 billion by 2032, exhibiting a CAGR of 11.3%.

Financial forecasting accuracy determines strategic success, yet most companies struggle with accessing comprehensive datasets from regulatory filings, market reports, and economic indicators. Internal teams may handle basic extraction but lack specialized expertise and advanced tools for systematic, large-scale financial data mining.

Outsourcing data mining to specialized providers delivers systematic extraction, quality assurance, and analysis-ready datasets. This transforms forecasting from resource-constrained processes into data-rich strategic intelligence. Let’s explore in detail!

How Does Outsourcing Data Mining Enhance the Accuracy of Financial Forecasting?

Access to Comprehensive Data Sources

Data mining enhances financial forecasting by systematically extracting relevant information from diverse sources that internal teams often lack the time or resources to process.

Key benefits include:

- Multi-Source Data Extraction: Access to data from financial documents, regulatory filings, market reports, and competitor information across various formats.

- Historical Data Recovery: Mining archived financial records and backfiles to identify long-term trends and patterns.

- Data Standardization: Converting raw financial information from various formats into consistent, analysis-ready datasets.

- Quality Assurance: Data validation processes to ensure reliability and accuracy for forecasting models.

- Organized Datasets: Structured data collection in preferred formats (Excel, CSV) for seamless integration into forecasting workflows.

Specialized Domain-Expertise

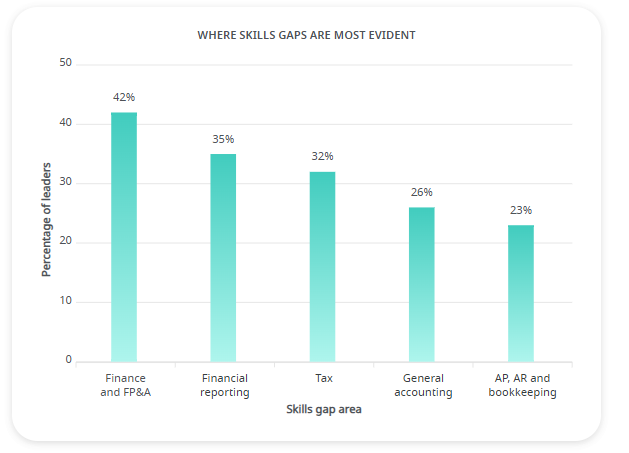

According to the Robert Half survey, 71% of finance and accounting leaders reported skills gaps within their department, and 72% of those leaders said the negative impact of those gaps has increased in the last year.

This talent shortage leaves organizations lacking the specialized expertise needed to systematically extract and prepare comprehensive financial data for accurate forecasting models:

Key benefits include:

- Cross-Functional Expertise: Outsourcing partners maintain teams of specialists with expertise in both financial markets and comprehensive data research methodologies.

- Immediate Access: Eliminates recruitment timelines for financial research analysts and data extraction specialists.

- Updated Market Intelligence: External teams stay updated with the latest financial data sources and text-mining techniques, including natural language processing-based extraction from news articles, regulatory filings, and market communications.

- Risk Mitigation: Ensures consistent access to specialized financial data mining expertise, reducing operational risk from losing internal staff skilled in comprehensive financial data research and extraction.

Leveraging Advanced Data Mining Infrastructure

- Specialized Data Mining Tools: Access to advanced web crawlers, database mining software, and AI- and machine learning–powered systems for classification, regression, clustering, and association rule mining. These tools not only uncover hidden patterns but also feed directly into forecasting models, which improves precision.

- AI-Driven Forecasting Models: Outsourcing firms often integrate deep learning and ensemble models optimized for financial time-series data. These models support scenario planning, anomaly detection, and demand forecasting, leading to enhanced decision-making.

Cost Efficiency and Risk Management

- Flexible Cost Structure: Data mining service providers allow organizations to allocate more resources toward comprehensive data mining during critical forecasting periods while scaling back during routine operations, resulting in more intelligent budget allocation.

- Efficiency Gains: Results in an increase in business efficiency through process optimization, freeing internal analysts from time-consuming data collection tasks to focus on model enhancement and strategic forecasting.

- Eliminated In-House Training: Outsourcing data mining eliminates the requirement for training and certification programs on complex financial data sources and mining techniques, while ensuring access to specialized data extraction.

- Reduced Infrastructure Costs: No capital expenditure on servers, software licenses, or maintenance contracts for data mining operations, allowing organizations to utilize resources in advanced forecasting tools and analytical capabilities that improve prediction accuracy.

- Secure and Compliant Infrastructure: Secure data ecosystems with strict access controls, encryption, and compliance with ISO 27001:2022 and ISO 9001:2015 standards for information security and quality management systems.

Scalability and Flexibility

Modern financial forecasting demands flexible scaling capabilities to handle varying data volumes and computational requirements:

- Dynamic Resource Allocation: Scale data extraction and research capacity up or down based on seasonal demands, market volatility, and business growth without maintaining permanent internal staff or infrastructure investments.

- Multi-Market Coverage: Expand data mining operations across new geographical markets and industry sectors without additional infrastructure investment, enabling comprehensive coverage for multi-regional forecasting models.

- Variable Workload Management: Handle peak research periods like earnings seasons or regulatory filing deadlines with additional data extraction resources, ensuring consistent data quality during critical forecasting cycles.

- Flexible Research Scope: Adjust data mining depth from high-level market trends to granular company-specific information across different time horizons and forecasting requirements as business needs evolve.

- Adaptive Data Coverage: Modify research parameters and data source selection to align with changing forecasting models and analytical requirements, maintaining relevance and accuracy across evolving business strategies.

Best Practices for Outsourcing Data Mining Services

Technical Infrastructure and Data Processing Capabilities

Comprehensive data mining for financial forecasting requires a robust technical infrastructure to handle diverse financial data sources efficiently. Organizations should evaluate providers based on their ability to enhance forecasting accuracy through superior data extraction and processing.

Key evaluation criteria include:

- Advanced Data Mining Tools: Web crawling capabilities, database extraction software, and document processing systems for comprehensive financial data discovery.

- Multi-Format Processing: Ability to extract and standardize data from various formats, including PDFs, databases, websites, and archived documents.

- Scalable Infrastructure: Cloud-based systems that can handle large-scale data extraction projects without compromising quality or delivery timelines.

- Integration Capabilities: Seamless data delivery in preferred formats (Excel, CSV, databases) that integrate directly with existing forecasting systems.

Industry Specialization and Domain Expertise

Financial data mining requires a deep understanding of industry-specific data sources, regulatory requirements, and market dynamics. Organizations should seek providers who offer specialized domain expertise to navigate forecasting challenges.

Key benefits include:

- Industry Expertise: Teams with expertise in financial data sources, regulatory filings, and market intelligence gathering specific to your industry.

- Regulatory Awareness: Understanding of compliance requirements and ability to extract data from regulatory documents, filings, and official sources.

- Industry-Specific Sources: Access to industry-specific databases, publications, and information sources that internal teams might lack.

- Customized Research Approaches: Financial research methodologies that align with specific forecasting models and analytical requirements.

High-Quality and Accurate Datasets

Effective data mining partnerships require transparent performance metrics and continuous improvement processes that directly impact forecasting accuracy. Organizations should select partners who demonstrate measurable value delivery.

Key evaluation factors include:

- Quality Metrics: Clear accuracy standards, error rates, and data completeness measures with regular performance reporting.

- Delivery Consistency: Proven track record of meeting deadlines and maintaining data quality across varying project sizes and complexity levels.

- Continuous Improvement: Regular process refinement and methodology updates to incorporate new data sources and extraction techniques.

- Responsive Support: Dedicated account management with collaborative platforms for project tracking and communication throughout the engagement.

Strategic Partnership and Cross-Collaboration

Successful data mining outsourcing requires a strategic partnership approach rather than transactional vendor relationships. Organizations should prioritize providers who demonstrate commitment to long-term collaboration and a deep understanding of their business needs.

Essential partnership elements include:

- Business Alignment: Deep understanding of organizational forecasting objectives and ability to adapt data mining scope to support evolving analytical requirements.

- Transparent Communication: Regular updates, feedback sessions, and clear reporting on project progress, challenges, and delivery timelines.

- Collaborative Approach: Ability to work closely with internal teams to understand data requirements and integrate seamlessly with existing forecasting workflows.

- Scalable Engagement: Flexible service models that can expand or contract based on seasonal demands, business growth, and changing analytical needs.

Data Security and Quality Governance

Data security is paramount when outsourcing financial data mining. Organizations must verify that providers hold ISO certifications for data security and quality standards.

Industry Use Cases and Applications

Financial data mining applications span multiple industries, each with unique requirements and opportunities for forecasting enhancement through comprehensive data extraction and analysis.

Banking and Financial Services

Banks leverage outsourced data mining to enhance financial forecasting by systematically extracting information from diverse financial sources, thereby improving risk assessment and market prediction accuracy.

Key Benefits Include:

- Enhanced Credit Risk Models: Comprehensive data extraction from regulatory filings, market reports, and industry publications provides broader datasets for more accurate creditworthiness forecasting beyond traditional financial metrics.

- Market Intelligence Gathering: Systematic mining of economic indicators, competitor information, and regulatory announcements enables proactive risk forecasting rather than reactive responses.

- Regulatory Compliance Data: Automated extraction from regulatory documents and compliance filings ensures forecasting models incorporate the latest regulatory changes and requirements.

Manufacturing and Supply Chain

Manufacturing companies rely on outsourced data mining to manage cost forecasting, demand planning, and supply chain optimization through comprehensive information extraction. Key applications include:

- Market Demand Analysis: Systematic extraction of industry reports, consumer trends, and economic indicators enables more accurate demand forecasting for production planning.

- Cost Trend Identification: Mining commodity price data, supplier information, and market analysis helps predict fluctuating material and labor costs for better financial planning.

- Competitor Intelligence: Comprehensive data extraction from industry publications and market reports provides insights for competitive positioning and strategic forecasting.

Energy and Oil & Gas

Energy companies leverage data mining for complex financial forecasting involving large-scale investments and volatile market conditions. Applications include:

- Commodity Price Intelligence: Systematic extraction of market data, geopolitical information, and economic indicators enables more accurate commodity price forecasting for strategic planning.

- Regulatory Compliance Monitoring: Mining environmental regulations, policy changes, and compliance requirements support accurate forecasting of regulatory costs and operational adjustments.

- Market Volatility Analysis: Comprehensive data extraction from industry reports, economic forecasts, and market analysis improves capital allocation and hedging strategy forecasting.