Our client is a global leader in providing sophisticated international trade system solutions, boasting over three decades of experience in the market. They offer fully customizable, off-the-shelf software solutions for modern logistics operations. Their core customer base—including freight forwarders, customs brokers, shipping agents, and airline cargo sales agents—relies on their logistic solutions to streamline workflows, ensure regulatory compliance, and optimize end-to-end global trade operations.

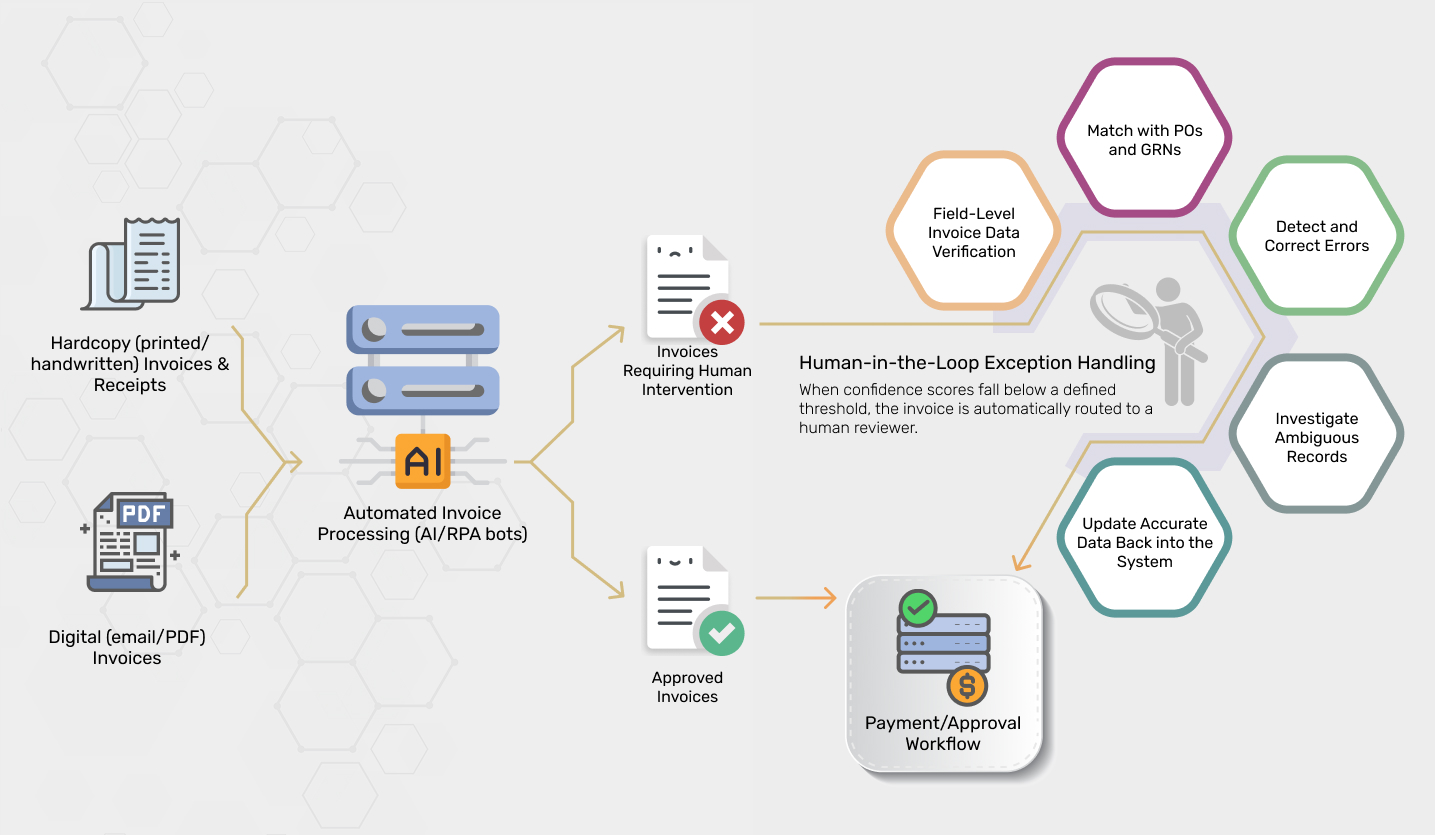

The client required a specialised provider for back-end invoice data validation to support their centralised, automated Accounts Payable (AP) system.

The client’s AP system received thousands of invoices monthly from various end users, each adhering to distinct data formats and submission protocols. Although the client’s proprietary AP platform automatically processed these bills, the inherent data variance caused it to generate a significant volume of exceptions. These exceptions were driven by issues like varying data formats, missing fields, and submission errors. Given that these invoice records directly impact financial transactions and adherence to trade regulations, these errors created a tangible risk of financial loss or legal exposure.

Therefore, the primary project requirements focused on:

The core difficulty lay in bridging the gap between the client's automated Accounts Payable (AP) system and the high volume of multi-format invoices it received, which frequently resulted in exceptions demanding manual intervention.

The key operational challenges we encountered were:

To help the client manage their high-volume invoice load with precision and continuity, we implemented a scalable staffing and process model built around consistency, control, and flexibility. The framework included a dedicated team of five full-time resources for invoice processing, supported by four part-time resources activated during seasonal peaks. Operating in rotational shifts across six days a week, the team ensured uninterrupted processing and quick turnaround.

Our solution encompassed multiple operational layers to maintain data accuracy and performance:

Every invoice flagged by the client’s AP system underwent a structured review and correction process guided by template-based SOPs. This ensured uniformity in handling diverse invoice formats and minimised workflow disruptions.

Invoices with poor scan quality or handwritten entries were verified manually. For high-risk fields, we adopted a double-key entry approach and escalated mismatches to senior reviewers for double accuracy assurance.

Our team interpreted invoices containing regional languages and trade-specific terminology, translating and standardising them into English. Over time, we built a reference glossary of recurring terms to maintain long-term consistency and contextual accuracy.

A project manager supervised both day and night shifts, overseeing workflows, conducting periodic QA checks, and ensuring each processed invoice record met the client’s quality benchmarks before submission.

Key financial data, such as invoice totals, tax codes, and currency amounts, was cross-validated against client master data and reference databases to prevent compliance breaches or financial losses.

To accommodate volume surges during month-end closings or regional holidays, the framework allowed for rapid scale-up through overtime and additional part-time staffing, ensuring deadlines were consistently met without backlog accumulation.

All work was performed exclusively on the client-hosted AP system under ISO 27001-certified protocols. Security measures included strict NDAs, Role-Based Access Control (RBAC), secure VPN Access, a ‘No Local Storage’ policy, and compliance with ISO 27001:2022 standards.

Invoice Data Validation with AI-Human Collaboration

Because the entire operation was managed within the client-hosted environment, establishing robust data security for sensitive business documents and maintaining confidentiality was paramount. We implemented a multi-layered security framework to meet this critical mandate:

All team members signed Non-Disclosure Agreements (NDAs) to fully safeguard the client’s intellectual property.

We enforced strict Role-Based Access Control (RBAC) to limit system access to authorised associates as per their defined roles & responsibilities.

Client system access was facilitated exclusively via secure, encrypted VPN servers.

Any personal/financial client data could not be downloaded, copied, or saved on any local or external device.

All data handling followed ISO 27001:2022 and GDPR security requirements to ensure secure and compliant processing.

Our reliable, human-in-the-loop methodology and ability to adapt to global time zones led to immediate and sustained success. The collaboration resulted in a strategic, long-term three-year engagement.

10,000+ Invoiced Processed Monthly

99.95%+ Data Accuracy Ensured

45% Faster Invoice Processing

40% Higher Operational Cost Savings

If you're struggling with exceptions, format variability, or compliance risks in your automated AP process, our human-in-the-loop financial data processing and validation approach can help. We guarantee the data accuracy and security that your critical accounts payable operations demand.